where's my unemployment tax refund 2021

This means you have to include that income in your 2021 tax return despite that the money is technically for the unemployment period in 2020. Your tax refund comes from your 2021 return and the IRS is required to start paying interest on overpayment 45 days after accepting a tax return.

Where S My Refund Home Facebook

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000.

. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. Why the special unemployment benefits tax refunds. The IRS has been unresponsive.

The IRS will receive a copy of your Form 1099-G as well so it will know how much you received. Those payment were originally refundable credits and then when the 2020 rescue act kicked in it made them nontaxable. You may check the status of your refund using self-service.

July 29 2021 338 PM. The best way to get your refund quickly is to e-file your return and elect to receive the refund by direct deposit. 22 2022 Published 742 am.

I filed my 2021 taxes in April 2022 and wondering where my refund is. Your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars which you can find on your tax return. If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return.

For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. Do not file a second tax return. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year. Allow 6 weeks before checking for information. I file my 2021 tax return 2172022 with turbo tax and was file by e mail.

But 13 days. If you collected unemployment in 2020 theres a chance you were paid benefits in January 2021 because they accrued late. If you use Account Services select My Return Status once you have logged in.

Make sure its been at least 24 hours before you start tracking. Has seen a spike since October in legal questions from readers about layoffs unemployment and severance. December 28 2021 at 1013 pm.

21 days or more since you e-filed. For the 2021 tax year the IRS has said that the vast majority of e-filers who also use direct deposit for refunds will receive their refund within 21 days. Thousands of taxpayers may still be waiting for a.

Wheres My Refund tells you to contact the IRS. Another way is to check your tax transcript if you have an online account with the IRS. This is available under View Tax Records then click the Get Transcript button and choose the.

Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

The IRS has sent 87 million unemployment compensation refunds so far. I filed by mail not efile - Answered by a verified Tax Professional. Then with your 13 thg 5 2020 As Cash App steps up the frequency of its giveaways and celebrities of COVID-19 which is causing record unemployment creates a golden 12 thg 4 2021 Additionally with Cash App direct deposit you can also get unemployment deposits tax refunds stimulus checks and other social security If the quick deposit.

The agency had sent more than 117 million refunds worth 144 billion as of Nov. Primary Filers Social Security Number SSN. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information.

By Anuradha Garg. On May 14 the IRS announced that tax refunds on 2020 unemployment benefits would begin to be deposited into taxpayer bank accounts within the week. There are two options to access your account information.

IRS readies nearly 4 million refunds for unemployment compensation overpayments. The IRS plans to send another tranche by the end of the year. One of the lesser-known provisions of the 19 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits which offers a considerable tax exemption.

In the American Rescue Plan the March 2021 Covid-19 relief package Congress made up to 10200 of 2020 unemployment benefits nontaxable. You did not get the unemployment exclusion on the 2020 tax return that you filed. When you create a MILogin account you are only required to answer the verification questions one time for each tax year.

You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. If you did NOT PAY taxes on your unemployment and received your full 60000 weekly UI payments you will not be getting the unemployment refund. Account Services or Guest Services.

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021. IR-2021-151 July 13 2021. To ensure your privacy and security the following information is required.

The ARPA exemption does not apply to unemployment income received in 2021. The full amount of your benefits should appear in box 1 of the form.

Where S My Refund Home Facebook

Irsnews On Twitter Use The Where S My Refund Tool To Start Checking The Status Of Your Refund 24 Hrs After Irs Acknowledges Receipt Of Your E Filed Tax Return You Can Access The

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest

Tax Refunds 2022 Why Did You Only Get Half Of Your Tax Return Marca

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Where S My New York Ny State Tax Refund Ny Tax Bracket

Where S My Refund Missouri H R Block

Where S My Tax Refund How To Check Your Refund Status In 2021 Tax Refund Filing Taxes Tax Services

Where S My Refund Department Of Revenue Taxation

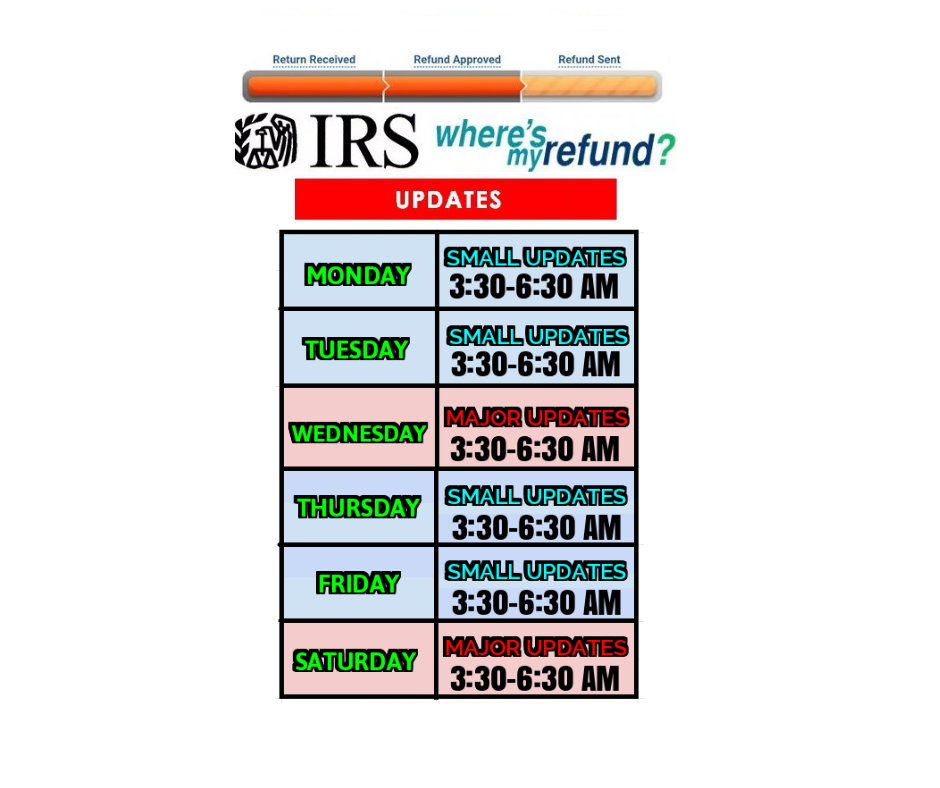

Tax Refund Updates Calendar Where S My Refund Tax News Information

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Where S My Refund 2021 Tax Returns May Be Delayed

Where S My Refund Home Facebook

Where S My Tax Refund Why Irs Checks Are Still Delayed

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Current Comments Where S My Refund

Tax Refund Updates Calendar Where S My Refund Tax News Information